I’m basically just making biweekly lump sum investments. I always thought that was dollar cost averaging, but is it? In theory, this makes an absolute ton of sense, right? I don’t ever really want to time the market so I’ve always been a huge fan of dollar cost averaging but the more that I had thought about it, I wondered if it actually made sense to do this.Įvery time that I am paid and money goes into my Roth IRA, I will then invest it in the market, typically into one of my current positions. You just want to spread your money out equally into a position and not try to time the market. If you’re dollar cost averaging, you don’t care. LifeSearch Partners Ltd is registered in England and Wales to 3000a Parkway, Whiteley, Hampshire, PO15 7FX, company number 03412386.As you can see, the initial purchase price is $150, meaning that you could’ve bought all $12K at $150/share, but you also could’ve had the share price drop the entire time meaning you bought at the high point. LifeSearch Partners Limited (FRN 656479), for the introduction of Pure Protection Contracts, who are authorised and regulated by the Financial Conduct Authority to provide advice and arrange Pure Protection Contracts. Ltd is authorised and regulated by the Financial Conduct Authority to provide advice and arrange non-investment motor, home, travel and pet insurance products (FRN310635) and is registered in England and Wales to Greyfriars House, Greyfriars Road, Cardiff, South Wales, CF10 3AL, company number 03857130.

Ltd for the introduction of non-investment motor, home, travel and pet insurance products (FRN 610689). Which? Limited is registered in England and Wales to 2 Marylebone Road, London NW1 4DF, company number 00677665 and is an Introducer Appointed Representative of the following: This will vary depending on how much money you withdraw. The pension freedom changes mean that you will be pay tax at your marginal rate – 0%, 20%, 40% or 45%. You’ve always been able to withdraw the remainder of your savings, but this was previously taxed at 55%.

#90000 LUMP SUM 7 YEARS FROM NOW FREE#

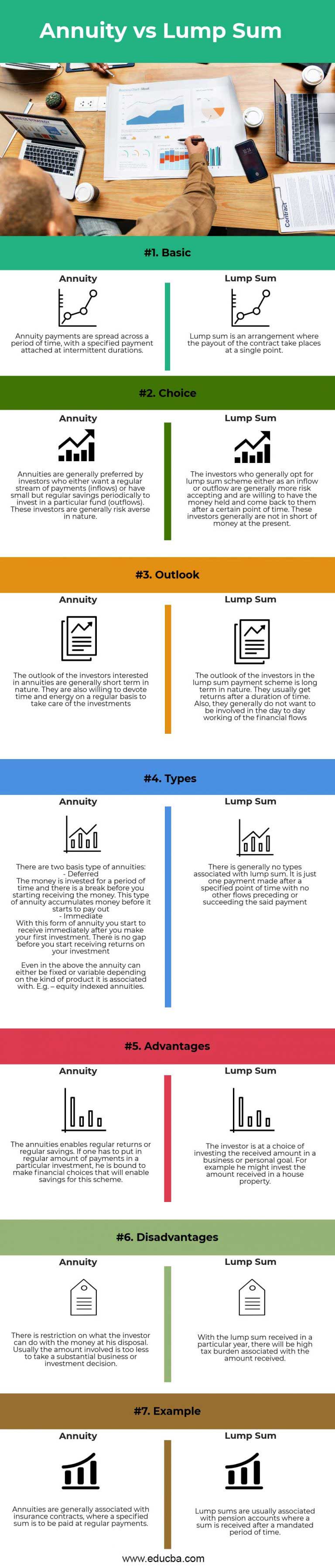

The first 25% of your pension can be withdrawn completely free of tax. It is now possible to take your entire pension fund in one go. Some 25% of each withdrawal is tax-free, and the remaining 75% subject to income tax. You take cash out when you need to, while the rest continues to grow. In theory, your pension can be used a bit like a bank or a savings account. They're 'uncrystallised' because you haven't moved the money out of the pot and into another product, such as income drawdown or an annuity. The unwieldy technical term for this is ‘uncrystallised funds pension lump sums’ – or UFPLS. You can leave your money in your current pension fund and take lump sums when you need to. There's another flexible way to take money from your retirement savings. The upside is that investment growth can provide higher returns and see your pot continue to increase in value. Since your money stays invested (as opposed to being turned into an annuity), and it's usually in the stock market, there is the risk that your fund may fall in value. Pension drawdown is where you keep your money invested when you reach retirement and take money out of (or 'draw down' from) your pension pot. The flipside is that if you die early, you won’t usually be able to leave any to your family, irrespective of how much of your fund has been paid out (unless you've taken out a joint-life, value-protected or guaranteed annuity).

You’ll receive a fixed regular payment each year until you die, however long you live. The big benefit of an annuity is that your income is guaranteed. AnnuityĪn annuity is a product that allows you to convert your pension fund into a regular income that will last for the rest of your life. We explain the main options below, and there's more detail in the rest of this guide. Once you've an idea of the size of your pot, you can start to think about what you might do with your pension fund when you retire.

0 kommentar(er)

0 kommentar(er)