Please do not submit IRS Form 4506-T to the university. Mail the form to the IRS at the appropriate address provided in the middle column of page 2.

TRANSCRIPTS IRSS ZIP

If you submitted a joint return, enter the name shown first.ġb The first Social Security number used on the tax return.Ģa If applicable, spouse's first and last name as shown on the tax return.Ģb If applicable, spouse's Social Security number as shown on the tax return.ģ Current name of the first tax filer and address, city, state and zip code. Step-by-step instructions for completing the paper form:ġa The first and last name as shown on the tax return. Joint tax filers must both be listed, in the order they appear on the tax return. PLEASE NOTE: You must enter names, Social Security numbers and street addresses exactly as they appear on the latest tax return. Have it sent to you so that you can upload a copy of it through FAST.

On the form, check Box 6a, "Return Transcript," to request the tax return transcript.PAPER: Complete an IRS Form 4506-T, available at, and submit it to the IRS as indicated on the form.If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript. -This requirement can be completed by using the Data Retrieval Tool (DRT) through FAFSA or.Online requests require the Social Security number, filing status and mailing address from the latest tax returns, an email account, a mobile phone with your name on the account, and your personal account number from a credit card, mortgage, home equity loan, home equity line of credit or a car loan.ONLINE: Visit Click on Get Your Tax Record, and then click on Get Transcript Online or Get Transcript by Mail.

TRANSCRIPTS IRSS VERIFICATION

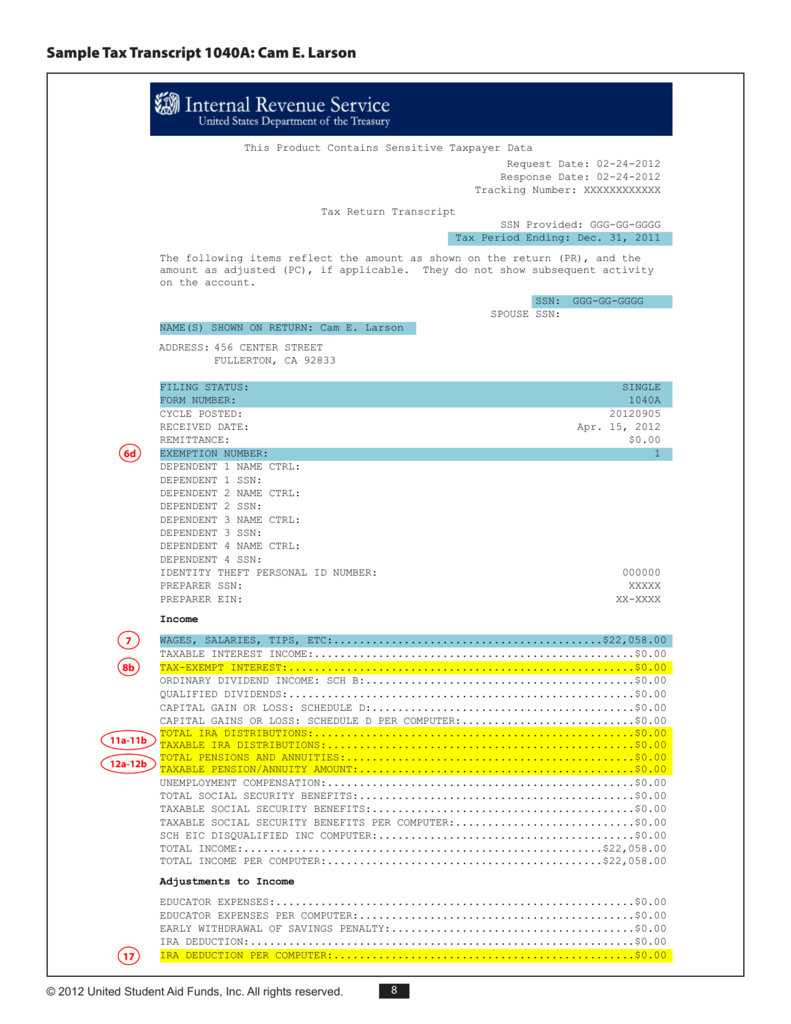

As part of the federal verification process, you may be required to provide a copy of an IRS Tax Return Transcript to confirm the information filed on your federal tax return.Īn IRS Tax Return Transcript can be obtained:

0 kommentar(er)

0 kommentar(er)